In the final days before EPA issues the 2020 volumes for the federal biofuel mandate and makes a ruling on the supplemental proposal offered in October, it’s critical to acknowledge that all available data shows there are no “lost gallons” of ethanol that need to be reallocated as part of these announcements. If anything, the Renewable Fuel Standard (RFS) mandates should be lowered to better reflect the realities of today’s infrastructure and consumer fuel demands.

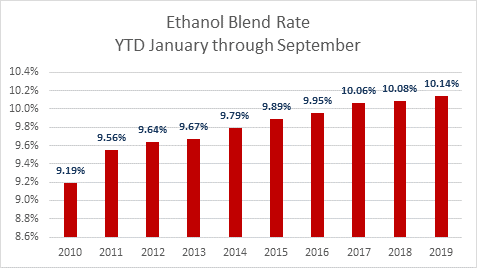

Data released recently by the U.S. Energy Information Administration (EIA) continues to show that small refinery exemptions (SREs) issued to waive RFS compliance burdens from some small facilities have had zero impact on U.S. ethanol consumption and blending. In fact, through September, the ethanol blend rate for 2019 is the highest ever recorded and total ethanol use is up 37 million gallons over 2018, showing ethanol consumption and blending are continuing to grow, uninterrupted and unchanged by SREs. While small refineries on the receiving end of waivers may not be responsible for biofuel blending themselves, ethanol is still being added to the products these refiners produce — just further down the supply chain.

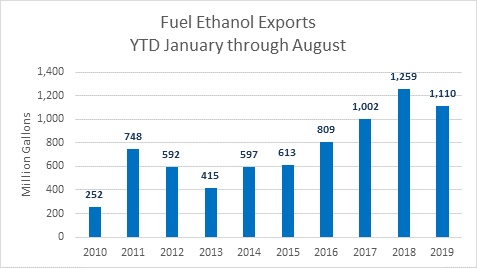

At the same time, a there has been a decline in U.S. exports of ethanol. Through September of 2019, the U.S. exported roughly 150 million fewer gallons of ethanol to other countries than during the same period of time in 2018. The impact of the international ethanol trade market not being the strength it once was for U.S. producers can be seen across the heartland and is compounded on top of other challenges related to floods and early freezes that have hit the farming community this year.

Barriers to U.S. ethanol trade will not be solved by increasing the domestic biofuel mandate. Rather, allowing a domestic “demand destruction” myth to go unchecked by imposing higher mandates here at home will only be a boon to biodiesel producers overseas.