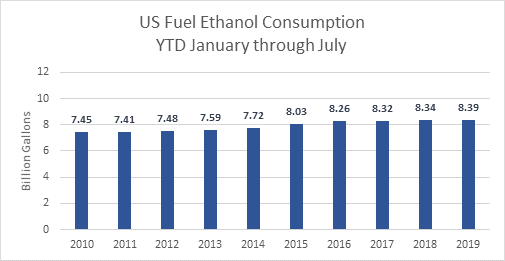

As we progress through 2019, one thing that has remained consistent is that U.S. ethanol consumption and blending are higher this year than they have ever been — a sign that small-refinery hardship waivers exempting some qualified facilities from Renewable Fuel Standard (RFS) blending obligations have not destroyed demand for ethanol. Take a look at the latest 2019 data.

- Through July of 2019, fuel ethanol consumption (the actual volume of ethanol gallons blended into the U.S. fuel supply) was up 47 million gallons over the same period in 2018.

- As a percentage of motor gasoline, ethanol accounted for 10.17 percent — also above 2018’s 10.05 percent “blend rate.”

On the home front, ethanol demand, as signified by consumption and blending, is steady and growing. Where there have been declines, however, is in the international market.

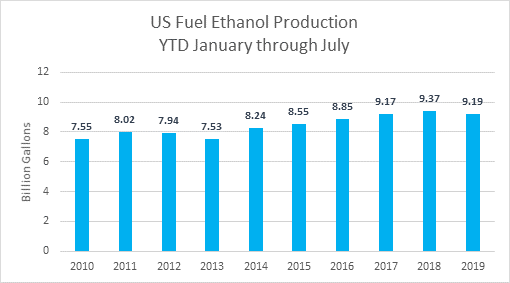

- Exports of U.S. ethanol have fallen due to trade policies, and domestic production has downsized in response.

- Ethanol exports dropped 162 million gallons through July of this year, compared to the same seven-month stretch in 2018.

- Corresponding to this, the U.S. is producing 175 million fewer gallons of ethanol this year.

As the numbers show, domestic demand for ethanol has continued to grow. The decline in production has much more to do with overseas factors than with the RFS or hardship waivers (SREs).

Topics