By mid-January, news sources have thoroughly exhausted reports on American’s Yuletide spending and attention inevitably turns to the day of reckoning: Tax Day. Thanks to Abraham Lincoln, this year procrastinating taxpayers get a few extra days to file and that means a few additional days of news.

Typically, stories focus on who doesn’t pay their fair share, but you won’t see the petroleum refining industry included in that list for good reason.

In 2014, refining companies paid $8.7 billion in income taxes, and another $2.9 billion in other taxes such as property, sales, and severance taxes. This amounts to $11.6 billion paid to local, state and federal governments. To put this in perspective, in one year, refiners paid about twice what it cost to widen the Panama Canal, a nine-year project scheduled for completion this June. That total represents $100 for every household in the United States. But that’s only part of the story, let’s dig a little deeper.

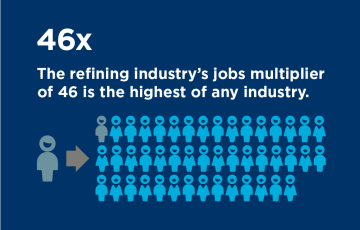

The petroleum refining industry also provides jobs, 70,000 direct employees, that’s 70,000 taxpaying employees to be exact. Including these jobs, the industry supports 3.1 million jobs throughout the U.S., accounting for more than 1.5 percent of the nation’s total jobs. Taxes generated by these 3.1 million jobs, along with the taxes paid by businesses that serve the refining industry, produce enormous government revenue. Adding in the previously mentioned $11.6 billion, the total refining sector contributions to our state, local, and Uncle Sam’s coffers are more than $113 billion, nearly $1000 for every U.S. household.

Of course, Tax Day is not solely about taking – there is some giving as well. Retailers across the country often help ease the pain by offering Tax Day freebies or discounts. Check it out.