Three-quarters of the way through an unprecedented year marked by a pandemic, an economic downturn and market volatility — and with a historic election just days away — we sat down with AFPM Chief Industry Analyst Susan Grissom to discuss the future of the fuel and petrochemical industries, what’s getting overlooked in the news, and the long-term impact of COVID-19, among other topics.

In recent months we’ve seen prognostications about the declining importance of oil and natural gas. What are your thoughts on these predictions?

Susan Grissom, AFPM Chief Industry Analyst: Commentators seem to thrive on speculation about potential changes in energy consumption trends and future demand. Perhaps that’s because the reality is less variable and therefore less exciting: oil and natural gas are critical to the United States and global economies and societies, and all indications point to that remaining the case for decades to come.

The U.S. Energy Information Agency’s 2019 International Energy Outlook projects that fossil fuels will supply 60 percent of primary energy consumption globally in 2050. The report also found that global liquid fuel demand will increase more than 20 percent in that time period, with liquid fuels still making up about 80 percent of transportation energy consumption in 2050.

The reasons for these increases are simple: the world will continue to become more populous and the global middle class will continue to grow. These billions of people will require energy to thrive; oil and natural gas are essential to meeting these energy demands.

What about future demand for fuels and petrochemicals?

SG: People sometimes fail to realize that crude oil has very little value until it is run through a refinery or is further processed at a petrochemical plant. Refineries are necessary to turn crude oil into products that can be used to power the world and petrochemical facilities are necessary to turn crude oil, natural gas liquids (NGLs) and other feedstocks into essential products that make modern life possible. So just as oil and natural gas are not going anywhere, neither are refineries and petrochemical facilities.

The importance of these industries goes beyond the millions of jobs they support and the products they produce; they are fundamental to America’s long-term energy security, which ensures reliable access to affordable energy for millions of people and businesses. This has a tremendous economic multiplier effect since all industrial sectors require energy to function. Similarly, a strong U.S. petrochemical industry means America has the ability to manufacture essential health-related and manufacturing components, with less reliance on imports. Refining and petrochemical manufacturing are, undeniably, strategically important sectors.

What, from a policy perspective, can be done that would allow these industries to continue providing vital products and security?

It’s crucial that policymakers avoid creating a regulatory environment that undermines the long-term viability of the U.S. refining and petrochemical industries. If that were to happen, we would find ourselves in the unenviable position of being utterly dependent on foreign nations for the fuels and petrochemicals that our economy and society rely upon.

Certainly, energy and petrochemical markets are global — and U.S. refineries and petrochemical manufacturing facilities are key participants. Many U.S. facilities operate most efficiently when they process qualities of crude oil that are produced outside the United States, and as a result they import crude oil from the global market, transforming it into affordable energy and essential products for Americans. Many U.S. facilities also export refined products and petrochemicals to other countries, which is a boon to the U.S. economy and jobs here at home.

To continue reaping the benefits of strong U.S. refining and petrochemical sectors, we need to support policies that enable oil and natural gas production, and to avoid policies that burden refineries with onerous regulations (the Renewable Fuel Standard is one example) and hinder access to critical global markets through tariffs and other mechanisms (e.g., a border tax).

What about the arguments that the COVID-19 pandemic has kickstarted an irreversible decline for refined products?

SG: The COVID-19 pandemic has precipitated significant, but transitory, changes in fuel consumption, eliminating some gasoline and diesel demand and a great deal of jet fuel demand — but the world will evolve from this point.

The argument that this is somehow a “new normal” is not reasonable. As Valero CEO Joe Gorder recently stated, the way we’ve all been living for the past six months is not the way most people want to continue living. Once the underlying driver of the pandemic has been ameliorated, it’s reasonable to believe that most people will largely return to their pre-pandemic lifestyle preferences.

Moreover, changes associated with COVID-19 haven’t led to major shifts in consumer demand from refined fuels to alternatives. Rather, because people have not been moving around in vehicles as much in recent months, less energy has been consumed for transportation. That said, EIA data show gasoline and diesel consumption have returned to more than 90 percent of pre-COVID levels. So, gasoline and diesel demand are coming back — and we’re not even driving to work and school like before.

Like many other industries, refiners have had a tough year. How are the industry’s medium- to long-term prospects looking?

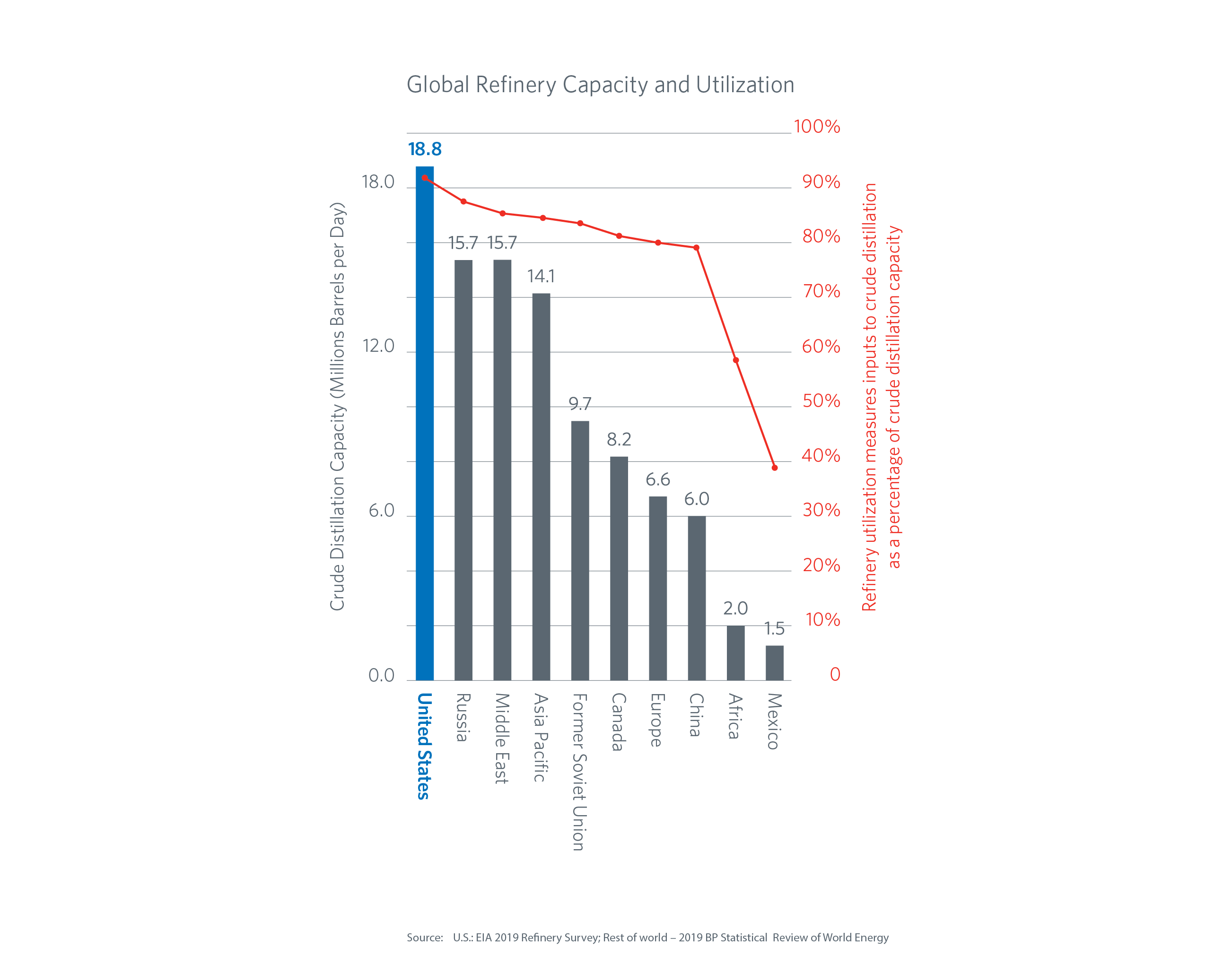

U.S. refineries are among the most complex and efficient in the world, and the U.S. refining industry is quite well-positioned to supply global demand as it rebounds — absent an unsurvivable policy and regulatory environment, of course.

In many other parts of the world, the outlook for refining is less optimistic. For instance, while U.S. refineries have historically operated at 95 percent of capacity in the parts of the world refineries operate at much lower utilization rates — and the higher the utilization, the more efficient and cost-effective a refinery.

As a result, U.S. refineries offer a cost-effective source of needed supplies of gasoline, diesel and other liquid fuels.

So, while the short-term outlook continues to depend upon the future of the pandemic, the industry’s longer-term outlook holds a lot of promise.

What about how electrification and electric vehicles (EVs) are impacting the fuel and petrochemical industries?

SG: This summer has unfortunately made the limitations of our electric grid painfully clear. The rolling blackouts in California were dramatic demonstrations of the grid’s inability to handle current power demands reliably. Even here in Virginia, outside of D.C., power went out multiple times this summer as the residential grid dealt with the increased energy demands from a larger number of people working from home. It’s hard to see how adding the huge burden of charging millions of electric vehicles onto this already overwhelmed system would result in a successful outcome.

EVs make up only about two percent of light duty vehicles in the U.S. right now — and before EVs can play a more significant role in the transportation network, there are a number of technology and infrastructure shortfalls that obviously must be addressed.

And while hydrogen fuels have gotten a fair amount of press coverage recently, the reality is we are still a long way from the feasible scaling of hydrogen or any other alternative fuel. Furthermore, any such large-scale switch would require significant increased costs to consumers.

It’s also worth noting that while pure EVs do not run on liquid fuels made from fossil fuels — some hybrids, of course, do — EVs still rely on fossil fuels for the petrochemicals that are used to make key components in the EV battery and a significant number of the components in the rest of the vehicle. The weight of the battery makes it imperative that the rest of the vehicle be as lightweight as possible while maintaining its structural integrity, and petrochemicals are often the ideal solution. And polypropylene and polyethylene are commonly used in the separator between the cathode and anode within the battery itself, as well as in the cell and battery casings. Moreover, most EVs also rely on electricity generated from fossil fuels to charge the battery, since more than 60 percent of the electricity generated in the United States in 2019 relied on fossil fuels.

Any thoughts in closing?

SG: There are currently very few realistic economic alternatives for transportation fuels and petrochemicals — and none that can entirely replace fossil fuels.

Like EVs, solar panels and wind turbines would not be possible without products made from oil and natural gas, which brings into question arguments about replacing oil and gas with wind and solar.

We rely on petrochemicals for everything from medical devices to phones, and I don’t see people giving up technology or advanced medical care anytime soon.

And growing sufficient soybeans or other crops for biofuels to substantially replace fossil fuels would entail an ecological footprint that would make the replacement pointless.